Economy News

Lukid Leaders Present Barkat Economic Plan For The Next Year

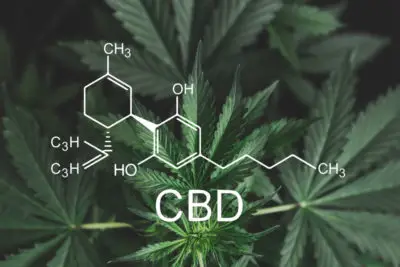

On Sunday, the honorable Prime Minister of Israel Benjamin Netanyahu and MK Nir Barkat presented the Likud Party’s economic plan ...Experts Believe Dearth of CBD Regulation is Evident in Florida Lawsuit

The lawsuit against First Capital Ventures and Diamond CBD in Florida is a reflection of the dearth of regulation in ...Slow Economic Growth In Gulf Countries Expected

The International Monetary Fund reduced the global growth outlook for the third time in 6 months to 3.3% due to ...Seven Banks Charged with Monetary Fine for Violating Banking Norms by RBI

On Tuesday, the Reserve Bank of India (RBI) imposed a monetary fine on seven public sector banks for violating various ...Hermes Says Sales in China Still Going Strong

The slowdown in China has come as a bitter shock for some of the biggest corporations in the world, and ...Creditors Give up on Anil Ambani Group Following Loss of 12,600 Crore

Money lenders gave up on the shares of Anil Ambani group companies which they owned as collateral soon after their ...UN Warns of Currency Wars and Show of Protectionism if Trade War Persists

The United Nations warned in a report that the world might encounter currency wars, widespread protectionism, and billion-dollar losses if ...Pinduoduo e-commerce Chinese rival to raise more than $1 billion

The cost of competing with the Chinese e-commerce enterprises JD.com and Alibaba are enormous. That has been witnessed by the ...Parks and Network Help Disney Beat Estimates

Walt Disney Company comfortably beat Wall Street estimates of its quarterly earnings, and much of that has to do with ...